A fire risk assessment for an HMO is a mandatory legal inspection that systematically identifies fire hazards within a property and evaluates the adequacy of existing safety measures. It is a critical process, not just for protecting tenants but for ensuring you, as the landlord or property manager, comply with UK fire safety law. This guide is for landlords, managing agents, and anyone designated as the ‘Responsible Person’ for a House in Multiple Occupation. By the end, you will understand your legal duties and the practical steps required for compliance.

As an HMO landlord or manager, you are legally designated as the ‘Responsible Person’ for fire safety. This is a significant legal duty under the Regulatory Reform (Fire Safety) Order 2005. Understanding this role is the first step towards compliance, as ignoring this responsibility can lead to severe consequences.

The law treats HMOs as higher-risk environments for good reason. They house unrelated individuals who often lead different lifestyles and may not know each other, which can increase vulnerability in an emergency. This unique mix of occupants, combined with shared kitchens and common areas, statistically increases the likelihood of a fire.

Under the Fire Safety Order, the Responsible Person is whoever has control of the premises. For an HMO, this is almost always:

If you fit one of these roles, the legal duty to ensure a “suitable and sufficient” fire risk assessment for your HMO rests entirely with you. It is your responsibility to identify fire hazards, assess the risks, and implement and maintain the necessary fire safety measures to protect all occupants. You can get a better understanding of the basics in our guide explaining what a fire risk assessment involves.

Failure to fulfil these duties can lead to severe penalties issued by the local Fire and Rescue Authority. Enforcement action is not a remote possibility; it is a common outcome for landlords who fail to meet their obligations.

The consequences of neglecting fire safety duties range from formal enforcement notices requiring immediate action, to unlimited fines and, in the most serious cases where lives are put at risk, a prison sentence. A documented fire risk assessment is your primary evidence of due diligence.

Recent legislation has further tightened these responsibilities. The Fire Safety Act 2021 clarified that the Responsible Person’s duties extend to the building’s structure, external walls (including cladding and balconies), and all doors between individual dwellings and common parts. This means your assessment must be comprehensive, covering every area that could contribute to fire spread. A proactive approach to fire safety has never been more critical.

| Responsibility | Governing Legislation | Practical Action Required |

|---|---|---|

| Conduct a Fire Risk Assessment | Regulatory Reform (Fire Safety) Order 2005 | Arrange for a ‘suitable and sufficient’ assessment and review it regularly (at least annually). |

| Implement & Maintain Measures | Regulatory Reform (Fire Safety) Order 2005 | Act on the findings. This includes installing alarms, fire doors, and emergency lighting. |

| Provide Clear Information | Regulatory Reform (Fire Safety) Order 2005 | Ensure tenants know what to do in a fire and understand the escape routes. |

| Assess Structure & External Walls | Fire Safety Act 2021 | Ensure the assessment covers the building’s structure, cladding, balconies, and flat entrance doors. |

| Cooperate with Other RPs | Regulatory Reform (Fire Safety) Order 2005 | If you share a building, you must coordinate fire safety measures with other owners or managers. |

| Keep Detailed Records | Regulatory Reform (Fire Safety) Order 2005 | Maintain a written record of your assessment, its findings, and the actions you have taken. |

This table serves as a roadmap for compliance. Staying on top of these duties is the most effective way to protect your tenants and your investment.

Understanding what happens when a fire risk assessor visits your HMO demystifies the process and helps you prepare. A professional assessment is not a box-ticking exercise; it is a methodical, five-step evaluation designed to protect your tenants and ensure you meet your legal duties as the Responsible Person.

Think of it as a logical journey, moving from identifying potential problems to creating a clear, actionable plan. A competent assessor follows a structured approach to ensure nothing is missed, turning an inspection into a valuable safety audit for your property.

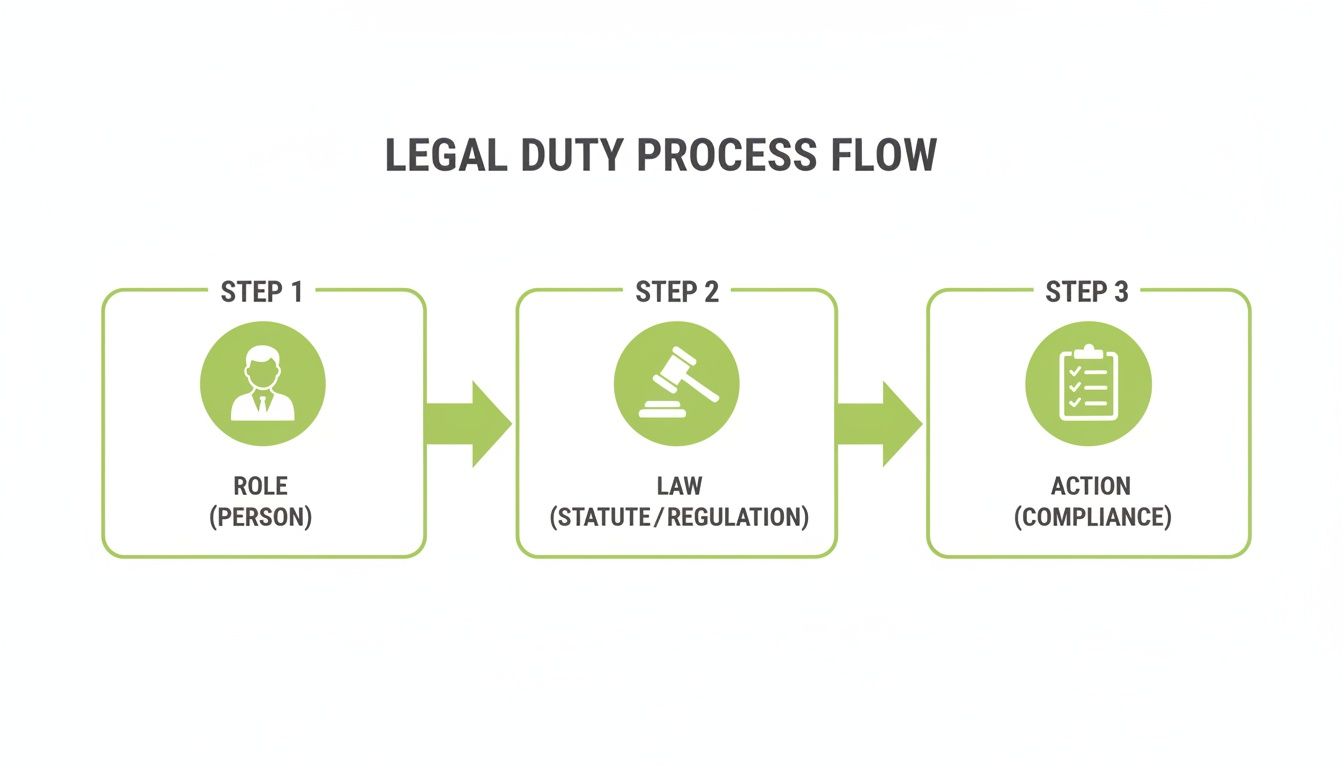

This flow chart breaks down the legal duty that underpins the entire process.

It all begins with defining who the Responsible Person is, understanding the law they must follow, and finally, taking the correct action to remain compliant.

First, the assessor will systematically walk through the property to identify potential fire hazards. This involves inspecting everything from individual tenant rooms to shared kitchens and hallways for anything that could start or fuel a fire.

Common fire hazards in an HMO often include:

Next, the assessor considers who is at risk. This is more complex in an HMO than in a single-family home. You have a mix of tenants who may not know each other and have different needs.

The assessor will consider how someone with mobility issues, hearing loss, or a language barrier might struggle to hear an alarm and evacuate quickly. The transient nature of HMOs is also a significant factor; new tenants will be unfamiliar with the building’s layout and the location of fire exits.

Once the hazards and at-risk people have been identified, the assessor evaluates your current fire safety measures. This is the core of any fire risk assessment for an HMO. Are the precautions you have in place sufficient for the level of risk in your property?

The assessor’s job here is to check that your safety systems are not just present, but that they are suitable, correctly installed, and properly maintained. This covers everything from the fire alarm and emergency lights to the integrity of your fire doors and the clarity of escape signage.

This hands-on evaluation determines whether your existing measures are sufficient or if improvements are needed to comply with the law.

After the on-site inspection, the assessor documents all significant findings in a detailed written report. This is not just paperwork; it is your legal record of the assessment. It must be clear, structured, and easy to follow.

A good report will not just list problems. It will identify hazards, explain the associated risks, and provide a prioritised set of practical recommendations for action, complete with realistic timescales. This allows you to build a logical and legally sound action plan.

Finally, the process concludes with a clear recommendation for when the next review should take place. Fire safety is not a “one and done” task. A fire risk assessment is a living document that needs to be reviewed regularly, typically at least annually, or sooner if there is a significant change to the property or its occupants.

This final step ensures you maintain a continuous cycle of risk management, keeping your HMO a safe and compliant home for all residents.

When a competent fire risk assessor enters your HMO, they view it through a different lens. They are not just looking at living spaces; they are methodically scrutinising every system and structural detail that contributes to fire safety. Knowing what is on their checklist is the best way to address potential problems before they become serious compliance issues.

The inspection is a deep dive into the specific components designed to prevent a fire, slow its spread, and ensure everyone can evacuate safely. A professional will move systematically through the property, checking that each safety layer is not only present but also fully functional and correctly maintained.

The first line of defence in any property is the alarm system. In an HMO, this is non-negotiable. With tenants potentially asleep or unaware of a fire starting elsewhere, a robust, properly installed system is critical. An assessor will verify the entire setup, not just glance at smoke alarms.

Here’s what they will be checking:

Once an alarm sounds, every tenant needs a clear and safe path out of the building. This escape route is their lifeline, and an assessor will physically walk it to ensure it is fit for purpose, day or night.

A blocked or compromised escape route can turn a manageable incident into a tragedy. The assessor’s focus is on guaranteeing that this path is always available and easily navigated.

Obstructions are one of the most common and dangerous failings. Your assessor will be looking for bicycles, pushchairs, or stored furniture cluttering hallways and stairwells, as these could impede a swift evacuation. They will also inspect the emergency lighting to ensure it activates automatically during a power failure to illuminate the route. Crucially, all fire exit doors must open easily from the inside without a key.

Compartmentation is a core fire safety principle. It involves dividing the building into fire-resistant cells using fire doors, walls, and floors. The goal is to contain a fire where it starts, slowing the spread of smoke and flames to protect escape routes and buy precious time for evacuation.

Fire doors are the most visible part of this system, but they are also a frequent point of failure. An assessor will meticulously check:

To prepare your property, you can review our comprehensive fire safety checklist for HMOs.

Receiving your fire risk assessment report is a significant step, but its true value lies in what you do next. A detailed report is useless if it is not acted upon. As the Responsible Person, you have a legal duty to translate its findings into a clear, documented action plan that can withstand scrutiny. This involves addressing risks logically and, most importantly, keeping your tenants safe.

First, read the report thoroughly. You need to understand not just what needs fixing, but why. A competent assessor will have explained the significance of each finding, connecting it directly to the risk it poses to life. This context is essential for making informed decisions.

Your report will likely identify a mix of issues, from minor administrative tasks to major building works. The best approach is to create a structured action plan to manage all remedial works. This plan should list every action required, assign responsibility for its completion, and set a realistic completion date.

Some of the most common problems found in HMOs include:

Each of these issues carries a different level of risk. That is why prioritisation is not just good practice, it is a legal necessity.

Any professional fire risk assessment for an HMO will categorise actions using a risk-based system, typically a straightforward High, Medium, and Low priority rating. This approach allows you to focus your time and resources where they will have the greatest impact on protecting lives.

The principle is simple: tackle the issues that pose an immediate and serious threat to life first. Resolve these before moving on to less critical compliance points. This demonstrates due diligence and is what your local Fire and Rescue Authority expects to see.

Let’s break down what these priority levels mean in practice.

High Priority Actions (Urgent – Address Immediately)

These are the most critical findings. They present a significant, immediate risk to life and require your full attention now. Failure to act on these not only risks a tragedy but also invites serious enforcement action.

Medium Priority Actions (Important – Address in the Short Term)

These are still significant risks that need to be dealt with promptly, but they might not pose the same immediate danger as high-priority items. You should aim to resolve these within a few weeks, or a couple of months at most.

Low Priority Actions (Necessary – Address in the Medium Term)

These are often minor compliance issues or recommendations for best practice. While they are still legally important and cannot be ignored, you can schedule them as part of your regular maintenance plan over the next few months.

By working through your report and assigning these priorities, you create a logical, manageable workflow. This documented plan becomes your best evidence that you are actively managing fire safety and fulfilling your duties as a responsible landlord.

Choosing the right fire risk assessor is one of the most important decisions you will make as an HMO landlord. Under UK law, the responsibility for ensuring the assessment is ‘suitable and sufficient’ rests with you as the Responsible Person. Simply having an assessment done is not enough; you must be confident the person carrying it out is genuinely competent.

A competent assessor does more than tick boxes. They have the training, experience, and knowledge to understand the unique fire risks in HMOs, from tenant vulnerabilities to the complexities of shared living spaces. Hiring an unqualified individual could result in a useless report, putting your tenants in danger and leaving you legally exposed.

It is your responsibility to do your homework before hiring an assessor. Competence is a tangible set of credentials and real-world experience that you can and should verify. Any credible assessor will be transparent about their qualifications and happy to provide proof.

Here are a few key things to check:

Investing in a professional fire risk assessment for an HMO is a non-negotiable part of your compliance budget. The cost reflects not only the assessor’s time on-site but also their expertise, the detailed analysis involved, and the creation of a legally sound report.

The price of an assessment can be influenced by several factors, ensuring the fee fairly reflects the complexity of your property.

| Factors Influencing HMO Fire Risk Assessment Costs |

| :— | :— | :— |

| Cost Factor | Description | Typical Impact on Price (£) |

| Property Size | The number of bedrooms, floors, and communal areas directly impacts inspection time. | +£50 to £200+ |

| Property Complexity | Complex layouts, multiple staircases, or unusual features require more detailed analysis. | +£75 to £150 |

| Number of Tenants | Higher occupancy levels increase the overall risk profile, requiring a more thorough assessment. | +£50 to £100 |

| Building Age & Condition | Older properties often have hidden structural issues or outdated fire protection, needing closer inspection. | +£50 to £150+ |

| Location | Assessors in major cities like London may have higher rates due to operational costs. | +£50 to £100 |

| Assessment Type | An intrusive Type 2 or Type 4 assessment is significantly more expensive than a standard Type 1. | +£200 to £1,000+ |

Ultimately, a professional assessment should be seen as an investment in safety and legal compliance, not just another expense.

A thorough, well-documented report is your primary evidence of due diligence and the foundation of your fire safety management system.

The cost for a fire risk assessment for an HMO can vary. In the UK, you can typically expect prices to range from £250 to £450 for a standard property. However, for larger or more complex buildings, this can exceed £1,400. These figures reflect the detailed on-site work and comprehensive reporting required. For a deeper dive into what drives these costs, you can learn about the pricing of fire risk assessments from industry experts.

Not all fire risk assessments are the same. For residential blocks, which include many HMOs, assessments are categorised into different ‘Types’ that define their scope.

For most HMO landlords, a Type 1 Fire Risk Assessment is what you will need. This is a non-destructive inspection focused on the common parts of the building, such as hallways, stairs, and landings. It is crucial that you confirm with your assessor that they are providing the correct type of assessment for your specific property. Getting this right is fundamental to meeting your legal obligations.

Completing your fire risk assessment for an HMO is not the end of the journey. It is the starting point for your ongoing safety management. As the Responsible Person, you have a legal duty to ensure your property remains safe and compliant long after the assessor has left. This means treating fire safety as a continuous process, not a one-off task.

The assessment report provides an excellent foundation, but its real value comes from your subsequent actions. It is about putting recommendations into practice and establishing a solid routine for managing fire safety day-to-day. Without this follow-through, even the most detailed assessment is just a piece of paper.

Effective fire safety management follows a simple but powerful loop: assess, act, and review. Once you have the assessment and have worked through the action plan, your job is to maintain those safety standards and regularly check they are still effective. This creates a lasting culture of safety and ensures your property can adapt to any changes.

Here are the key ongoing duties you cannot afford to ignore:

A fire risk assessment is a living document, not a static certificate. It must be formally reviewed to ensure it remains suitable and sufficient for protecting the lives of your tenants.

The law is clear: you must keep your assessment under review and update it when necessary. While there is no official expiry date, best practice, strongly recommended by Fire and Rescue Authorities, is to conduct a full review at least annually.

However, you are legally required to commission a new assessment sooner if any significant changes occur that could affect the original findings. This is not optional.

These changes include:

By building this review process into your annual property management schedule, you ensure your fire risk assessment for your HMO is always an accurate reflection of the property. It is the only way to remain compliant and, most importantly, keep your tenants safe.

To help you understand your legal duties, here are straightforward answers to the questions we hear most often from HMO landlords and property managers. Clarity on these points is the first step towards confident compliance.

The law, specifically the Regulatory Reform (Fire Safety) Order 2005, states your assessment must be kept up to date. While it does not specify a rigid expiry date, industry best practice and fire authority guidance are clear: a full review should be conducted at least annually.

Think of it as an MOT for your property’s fire safety. You are legally required to obtain a completely new assessment if there are significant changes, such as altering the building’s layout, a change in tenant demographics (e.g., housing more vulnerable people), or after any fire incident, no matter how small. This keeps the document live and relevant.

Legally, yes, if you are ‘competent’ to do so. The law permits the designated ‘Responsible Person’ to carry out the assessment, but competence is the key requirement. This means having the necessary training, experience, and a solid understanding of fire safety principles, especially within a complex residential setting like an HMO.

For a very small, simple property, a landlord with the right background might manage it. However, most HMOs present layers of risk that are easy to miss. Using a qualified, independent assessor is by far the safest option. It ensures your fire risk assessment for your HMO is ‘suitable and sufficient’, providing a robust defence if the worst should happen.

This is an important distinction that many landlords misunderstand. They are two entirely different processes serving different purposes.

A council inspection for an HMO licence primarily checks that you meet minimum housing standards under the Housing Act, such as room sizes, amenities, and basic facilities. A fire risk assessment, on the other hand, is a specialist safety audit required by the Fire Safety Order. It is a much deeper analysis of every potential fire hazard and safety measure throughout the property.

A valid, up-to-date fire risk assessment is a vital piece of evidence you will need to satisfy both fire regulations and the council’s own licensing team. One does not replace the other.

Ensuring your HMO is fully compliant is a major responsibility, but you do not have to manage it alone. HMO Fire Risk Assessment delivers professional, competent fire risk assessments designed specifically for the unique challenges of HMO properties.

Book Your Certified HMO Fire Risk Assessment Today

A fire door inspection is a systematic, detailed check to verify that a fire doorset is functioning correctly and meets all legal UK standards. It...

As a landlord or manager of a House in Multiple Occupation (HMO) in the UK, you are legally responsible for ensuring your property’s fire doors...